Fintech Giant FIS Global and EdTech Startup Electus Bridge the Gap Between Childhood Learning and Adult Responsibilities with Life Hub Card Integration

EdTech social enterprise startup partners with fintech giant to provide card services to its learners for its first-of-its-kind education app that improves quality of life.

21 May 2024, Tampa, Florida – FIS Global and Electus Global Education, both Florida based, have announced a new partnership to enhance ‘happy-life skills’ education app, Life Hub, coined as a ‘launchpad for future happiness and security’. The app, developed by Electus, integrates a new card system powered by FIS and Dash Solutions, an innovator in digital payments. This development aims to address critical social disparities stemming from a widespread gap in financial literacy skills.

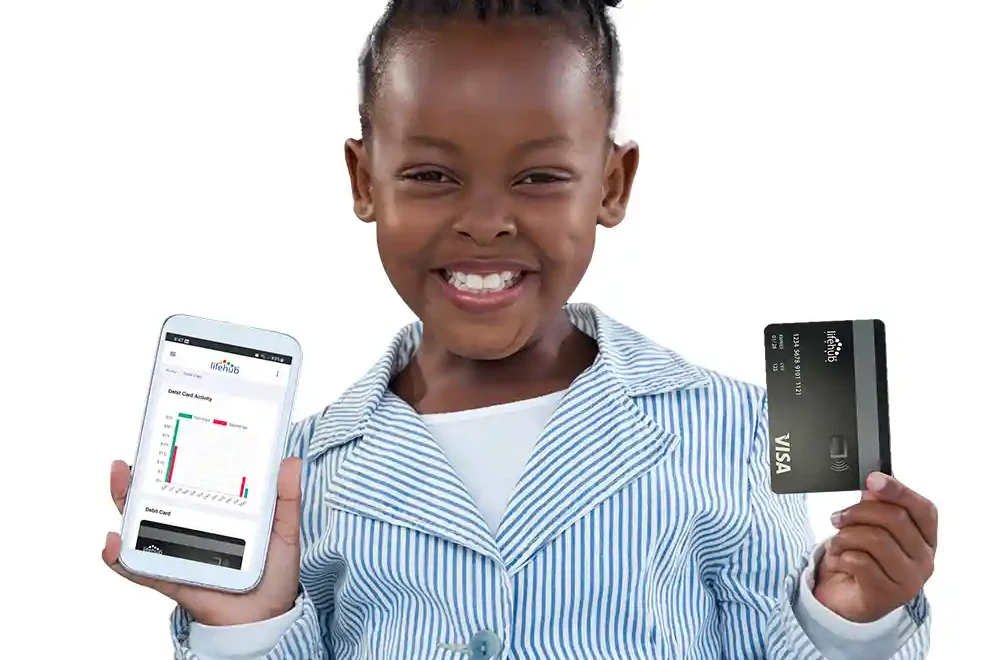

The Life Hub app provides a progressive alternative to traditional education systems, promoting life-enhancing outcomes for the individual learner and wider society. Life Hub catalyzes economic, career and life opportunities for school-aged children, up to the age of 18, offering experiential financial literacy, entrepreneurship, and career/work-readiness education (FLEC) through hands-on childhood learning, earning, and banking-style tools. Distinguishing itself in the competitive edtech/fintech landscape, Electus has created an educational ecosystem that bridges childhood learning and adult-life responsibilities. Life Hub engages kids in real income generation through childhood learning modules called edu-jobs, curated on a digital Jobs Center.

Fundamentally designed to improve life outcomes, and level the playing field in education and careers, Life Hub serves young people from all socioeconomic backgrounds through its SAAS model paid service. Underscoring Electus core ethos, the Life-Hub pricing model is bolstered by the startup’s commitment to accessibility, which is supported by partners and corporate sponsors. Together, they enable the distribution of Life Hub’s life-changing technology to underserved communities by providing a quota of fully funded licences each month.

Life Hub’s innovative technology, launched in 2022, and this fresh partnership expands the impact further with the integration of their FIS and Dash powered Life Hub VISA Debit Card, and – distinctively – payment of monthly “Edu-Job Earnings” which children manage using their integrated, transactions dashboard. The platform’s 1,500 edu-jobs, designed by an in-house team of educators, cover a large range of real-world topics, preparing them for future financial independence and security. From vocational subjects to AI, creative careers, geography, starting a business, social studies, and STEM, Life Hub is trusted by schools, school districts and youth organizations nationwide.

Life Hub’s flexible education model meets national standards and integrates seamlessly into curriculums, proven by successful collaborations with The Boys and Girls Clubs, and Big Brothers Big Sisters since its launch to market.

Integrating FIS and Dash Payment solutions with Life Hub’s globally patented, AI-driven technology, offers a holistic 360 approach to childhood learning, setting children up for a stable and prosperous life. Life Hub’s approach is backed by peer-reviewed studies that prove a link between experiential and financial education with positive life and societal outcomes. Their education model based around ‘happy-life skills,’ empowers children to live their best lives, breaking generational cycles of poor money management.

The Life Hub approach addresses some of the most profound societal issues including equality of opportunity – financial empowerment and social upward mobility – and broader outcomes including the prevention of substance abuse, domestic violence, crime rates, family stability and overall health [see citations]

With unarguable statistics [see citations] pointing towards a societal money-management skills gap, the partnership also aims to democratize access to digital money management tools in unbanked communities. Present in 58 countries, FIS’s technological expertise and global market reach, combined with the globally patented Life Hub solution, support Electus’ plans for global expansion over the next decade.

Dash’s innovative payment solutions and robust technology stack play a crucial role in Life Hub’s new FIS powered Life Hub VISA Debit Card. When combined with a monthly earned income experience, Electus has been able to further differentiate Life Hub it from banking-and-gamified-only competitors.

The collaboration with FIS is a significant milestone for Electus and follows the May 2024 release of Life Hub 3rd generation and entrance into new markets including homeschools, micro-schools, juvenile reform, and youth sports. Electus has pivoted away from the fin-lit narrative that saturates competitor messaging to focus on what really matters: future happiness, health, economic security, stable families, and social upward mobility.

Electus CEO Patricia Kampmann emphasizes that every business decision is based on tangible and universally understood positive outcomes. “We are on a mission to launch a million happy futures,” she says, highlighting the program’s transformative potential. “Our partnership with FIS Global allows us to level-up our impact, mixing income earning opportunities, with consumption and banking-style tools – a unique offer delivered in a way that is secure, scalable, and impactful.”

Ian Logan from FIS Global highlights the significance of the collaboration, which empowers children with practical, hands-on money management and consumption skills, fostering financial inclusion and literacy from a young age.

“We are thrilled to partner with FIS and Electus to help enhance the LifeHub experience for its users,” says Stephen Faust, CEO of Dash Solutions. “This collaboration is a testament to our mission of empowering our customers and delivering value beyond the payment.”

For more information about Life Hub, Electus, and how to get involved with this groundbreaking education and financial technology , visit www.lifehubeducation.com or email info@electuseducation.com.

ENDS

NOTES TO EDITORS

Contact

Press Contact and Partnerships: annagrace.dunoyer@electuseducation.com +34 664 342 383

Web: LifeHubJobs.com

Life Hub Contact for Demos and Technical Queries: support@electuseducation.com

About Electus Global Education

Electus Global Education is on a transformative mission to launch a million happy futures by empowering children with essential life skills through financial literacy, entrepreneurship, career readiness, and practical money management. Our commitment to turning education into action aligns with several United Nations Sustainable Development Goals, including Quality Education (SDG 4), Reduced Inequalities (SDG 10), and Economic Growth (SDG 8). By equipping the next generation with these crucial skills, Electus not only fosters individual financial confidence and self-sufficiency but also contributes to sustainable economic development and reduced social disparities.

About Life Hub

Life Hub by Electus Global Education revolutionizes learning by connecting educational outcomes with real-world financial and entrepreneurial applications. The platform focuses on the five key pillars of financial literacy: Earn, Save, Spend, Invest, and Give. This innovative approach supports Sustainable Development Goals such as Quality Education (SDG 4) and Decent Work and Economic Growth (SDG 8). Life Hub’s use of experiential childhood learning tools ensures that students not only understand financial concepts but also apply them, preparing them for a future where they are financially knowledgeable and capable.

About Dash Solutions

Dash Solutions is a payments platform empowering thousands of customers with digital payment and engagement program management tools. Founded and headquartered in Birmingham, Ala., Dash Solutions’ versatile technologies and configurable payment solutions help businesses operate more effectively. Discover how we’re transforming digital payments at DashSolutions.com.

About FIS Global

FIS Global is a leading provider of technology solutions for merchants, banks, and capital market firms globally. FIS aims to advance the way the world pays, banks, and invests, embodying the spirit of innovation and excellence in financial services. The company’s mission supports the United Nations SDGs, particularly Industry, Innovation, and Infrastructure (SDG 9) and Partnership for the Goals (SDG 17). Through this partnership, FIS Global leverages its vast technological capabilities to promote sustainable and innovative financial solutions across different demographics

CITATIONS

Family Stability

-

- Lower Divorce Rates: Financial literacy can reduce divorce rates by addressing one of the leading causes of marital breakdown—financial stress (Early Intervention Foundation).

-

- Stronger Family Bonds: Families with financial education are better able to plan for the future together, fostering stronger family bonds (Early Intervention Foundation).

-

- Intergenerational Knowledge: Financial literacy is often passed down from parents to children, creating a cycle of financial stability and stronger family units (Early Intervention Foundation).

-

- Crisis Management: Financial education prepares families to handle financial crises effectively, reducing the strain on family relationships (Early Intervention Foundation).

Economic Empowerment

-

- Wealth Building: Financially literate families are more likely to engage in wealth-building activities, such as investing and saving for the future (Early Intervention Foundation).

-

- Economic Security: Financial literacy contributes to long-term economic security, reducing the anxiety and conflicts that can arise from financial instability (Early Intervention Foundation).

-

- Home Ownership: Educated families are better equipped to navigate home ownership, a key component of family stability and wealth building (Early Intervention Foundation).

-

- Debt Management: Families with financial literacy skills manage debt more effectively, reducing financial stress and improving family dynamics (Early Intervention Foundation).

Community and Social Benefits

-

- Community Engagement: Financially educated families are more likely to engage in community activities and support local initiatives, strengthening community ties (Early Intervention Foundation).

-

- Reduced Poverty: Financial literacy helps lift families out of poverty, improving their overall quality of life and reducing the social issues associated with poverty (Early Intervention Foundation).

-

- Social Mobility: Financial education provides the tools necessary for social mobility, helping families improve their socioeconomic status over generations (Early Intervention Foundation).

-

- Crime Reduction: Financial stability within families reduces the likelihood of engaging in criminal activities, contributing to safer communities (Early Intervention Foundation).

Career Readiness

-

- Job Market Advantage: Experiential learners have a 50% higher employment rate post-graduation (Practera).

-

- Leadership Skills: Leadership skills improve by 65% through hands-on career readiness programs (Practera).

-

- Professionalism Boost: Students exhibit 45% more professionalism after experiential childhood learning experiences (Practera).

-

- Critical Thinking: Experiential learning sharpens critical thinking skills by 55% (Practera).

-

- Networking Skills: Practical career programs enhance networking skills by 60% (JA Bay Skills) (Junior Achievement).

-

- Internship Success: Students involved in internships are 70% more likely to secure their first job within six months of graduation (Practera).

-

- Professional Networks: Experiential childhood learning expands professional networks for 65% of participants (Junior Achievement) (Practera).

-

- Interview Skills: Hands-on career programs improve interview skills by 50% (Practera).

-

- Job Readiness: Students are 75% more job-ready after completing experiential learning projects (Practera).

-

- Resume Building: Practical experiences enhance resume quality, making students 60% more competitive in the job market (Junior Achievement) (Practera).

Overall Skills, Happiness and Life Outcomes

-

- Confidence Surge: 90% of experiential learners report increased self-confidence (Junior Achievement).

-

- Higher Engagement: Experiential activities lead to a 75% increase in student engagement (Practera).

-

- Better Teamwork: Teamwork skills improve by 50% in hands-on learning environments (Practera).

-

- Emotional Intelligence: Social and emotional learning is boosted by 60% through experiential methods (Junior Achievement).

-

- Resilience Training: Students develop 45% more resilience through practical learning experiences (Practera).

-

- Decision Making: Experiential learning improves decision-making skills by 70% (Junior Achievement).

-

- Communication Skills: Students enhance their communication abilities by 65% through interactive learning (Practera).

-

- Leadership Qualities: Hands-on projects boost leadership qualities by 60% (Practera).

-

- Adaptability: Experiential learning increases adaptability in students by 55% (Junior Achievement).

-

- Collaboration: Team-based activities improve collaboration skills by 50% (Practera).

Societal Benefits

-

- Economic Contribution: Experiential learning contributes to a 70% increase in community economic growth (Junior Achievement USA) (Junior Achievement).

-

- Healthier Choices: Financial literacy education reduces health-related stress by 40% (JA Bay Skills) (Junior Achievement).

-

- Crime Reduction: Communities see a 30% reduction in crime rates with higher education levels in financial literacy and career readiness (Junior Achievement).

-

- Stronger Communities: Experiential learning strengthens community bonds by 60% (JA Bay Skills).

-

- Better Public Health: Financially literate individuals make healthier choices, reducing public health issues by 50% (Junior Achievement).

-

- Economic Impact: Communities with strong experiential learning programs see a 40% increase in local economic activity (Junior Achievement USA) (Junior Achievement).

-

- Employment Rates: Areas with experiential learning initiatives experience a 30% rise in employment rates (Junior Achievement).

-

- Community Involvement: Participants are 70% more likely to be involved in community service (JA Bay Skills).

-

- Crime Reduction: Educational programs focusing on practical skills help reduce crime rates by 25% (Junior Achievement).

-

- Healthier Lifestyle Choices: Financial literacy and career readiness education promotes healthier lifestyle choices, improving community health by 35% (JA Bay Skills) (Junior Achievement).

Impact of Financial Literacy Education on Domestic Violence Outcomes

Prevention of Financial Abuse

-

- Empowerment through Knowledge: Financial literacy education empowers victims by providing them with the knowledge and skills to manage their finances independently, reducing their vulnerability to financial abuse by partners (Physorg) (NRC DV).

-

- Recognizing Financial Abuse: Education programs help individuals recognize signs of financial abuse, which is often a component of domestic violence, enabling them to seek help earlier (NRC DV).

-

- Financial Independence: Financial literacy promotes financial independence, which is crucial for victims planning to leave abusive relationships, providing them with the means to support themselves (Futures Without Violence).

Youth and Financial Education

-

- Youth Crime Reduction: Financial literacy programs targeting youth have been shown to reduce crime rates among young adults by providing them with the skills to manage their finances and avoid financial pitfalls (U.S. Department of the Treasury).

-

- School Programs: Integrating financial literacy into school curricula can preemptively address factors leading to juvenile delinquency (CRS Reports).

-

- Life Skills for Young Adults: Financial education in schools equips young adults with essential life skills, reducing their need to resort to crime as a means of financial survival (U.S. Department of the Treasury).

-

- Scholarship Awareness: Awareness of scholarships and financial aid through financial literacy programs can keep students in school and away from crime-prone environments (Treasury.gov).

Community Benefits

-

- Community Crime Rates: Communities with robust financial literacy programs experience lower overall crime rates due to improved financial well-being of residents (U.S. Department of the Treasury).

-

- Economic Empowerment: Financially educated communities are economically empowered, reducing poverty-driven crimes (CRS Reports) (Treasury.gov).